The Inland Revenue Board (“IRB”) has announced the implementation of the Stamp Duty Voluntary Disclosure Programme (“SDVD”), which will be effective for six months from 1 January 2026 to 30 June 2026.

|

|

Details |

|

Scope of the SDVD |

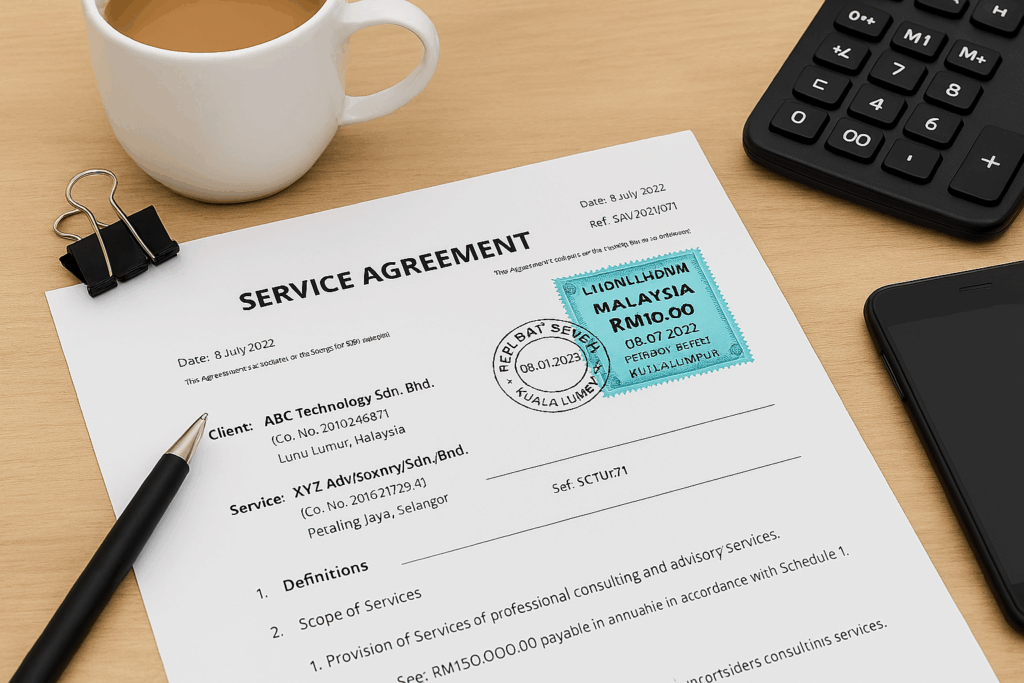

All instruments executed between 1 January 2023 and 31 December 2025, provided that:

|

|

Key features of the SDVD |

Effective 1 January 2025, the penalties for late stamping are as follows:

Under the SDVD programme, such penalties will be fully waived, provided the instrument executed between 1 January 2023 and 31 December 2025 is submitted for stamping and the relevant stamp duty is paid between 1 January 2026 and 30 June 2026.

The penalty exemption is granted automatically upon payment of stamp duty. Although penalties may still be reflected on the Stamp Duty Return Form or Notice of Assessment, these will be eliminated during the payment process. The penalty amount will be shown in the “Penalty Waived” section and will not be included in the “Total Amount Payable”.

Instruments stamped under SDVD programme will not be audited. However, this programme does not prevent IRB from auditing other unstamped instruments not covered under the SDVD. |

This SDVD provides an opportunity for taxpayers to address legacy stamp duty exposures. While the programme allows for penalty exemption and audit certainty in respect of qualifying instruments, taxpayers should carefully assess their positions and ensure timely compliance within the prescribed period.